Don’t get caught out by poorly considered checkout experiences. In the UK alone over 45% of shoppers have abandoned a purchase because of payment-related issues. It’s an instant loss of sales. But something that can be fixed.

To give you the answers you need, we’ve partnered up with payments platform Adyen. With their help, we’ve got three key steps you can take to reduce abandoned carts and increase your conversion rates.

How to reduce abandoned carts in three steps:

- Let shoppers pay with their preferred payment options

- Make sure your checkout is optimised on different devices

- Add loyalty and incentives for your shoppers

Read on to discover exactly what is required for each of these steps.

1. Let Shoppers Pay With Different Payment Methods

Getting to the checkout, filling in details, then discovering you can’t use your preferred payment method isn’t a good experience for your customers. Depending on where you are and where your customer is from, understanding the differences in the payments landscape across the regions you’re selling to is vitally important.

There are countless providers out there – global, local, national – catering to a vast number of shoppers and their requirements. Getting your payment mix right in different regions can be game-changing for your sales.

Actions you can take:

- Match shoppers to payment offers

Analyse where your shoppers come from versus your payment method offerings. Don’t pull providers out of thin air. Use data to identify the regions in which you’re performing best, and research how these local shoppers like to pay. Satisfy these requirements and you’ll increase conversions and encourage them to buy from you again.

- Localise your checkout

Knowing your target audiences means speaking their language. Literally. Ensure your checkout caters to all your customers by offering localised languages and tax specifications.

- Add new payment methods to your checkout

You can shortlist these payment methods when relevant. Whether it’s online or in-store, ensure you have all payment methods covered. For example: card, cash or wallets such as Apple Pay and Google Pay, which we are seeing increased use of across channels.

- Provide dynamic payment methods

Avoid overwhelming your customers with a dizzying list of payment options by dynamically serving a selection based on their location. This means shoppers in Germany will see methods such as SEPA direct debit, while shoppers in China will see methods such as Alipay, UnionPay, and WeChat Pay.

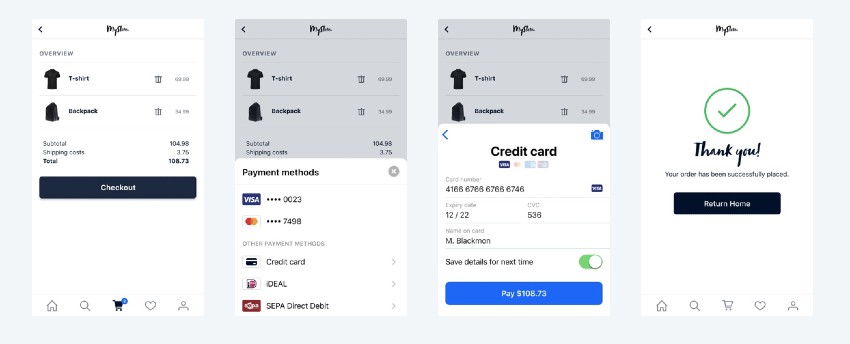

2. Make Sure Your Checkout Works on Different Devices

According to Statista, the current number of smartphone users in the world is 3.5 billion. This number is expected to rise to over 7 billion by 2023. So it’s safe to assume your customers are paying, or will be paying from their smartphone, tablet, or other mobile device.

Actions you can take:

- Test your checkout

You should test your checkout process on multiple devices and operating systems. As with all pages, the checkout should be mobile-first.

- Keep it simple

Simplicity is key when it comes to mobile forms. Minimize the required fields and number of steps and only ask for key information so your customer can get on with their purchase.

- Navigable layouts

Customers expect straightforward layouts that are easy to navigate. So make data input easy with large buttons and clean layouts.

- Use in-app payments

Don’t give your customers a reason to drop off. If you have an app, opt for in-app payments instead of a redirect which can slow things down as the page loads.

3. Add Loyalty and Incentives for Your Shoppers

The thrill of shopping takes a steep decline as you enter your card details, so why ask your customer to do it more than once? By recognizing repeat customers at checkout, you increase the chances of the payment being made there and then.

Offer first-time customers the chance to save details for future purchases, which they authenticate with a password, CVV, or fingerprint. Details are then captured during the first purchase, issuing you with a secure token that you can use to charge future purchases.

Actions you can take:

- Use tokenization

Use tokenization to securely capture and store card details. Card data is replaced with a secure token that can be used for future purchases. So you can provide a seamless experience while limiting your PCI scope.

- Reward Schemes

Add new reward schemes attached to payment cards.

- Work with partners

Work with partners that can gather valuable data on buyer behaviour. Stay up to date with what customers have come to expect from their payment journeys, and you won’t go far wrong.

- Link payment information to your loyalty program

Delight those who have stayed loyal by offering point-based rewards, priority access to products, or exclusive offers.

If you want to learn more about Adyen and discover whether this is the right payment solution to integrate with your store, get in touch with our team of ecommerce experts.

Use the contact form or call us on 0161 762 4920.