Pay By Bank (Bank-to-bank / A2A) is something you will hear more and more over the next year. I guarantee.

If I’m honest, I think it will have as big of an impact as wallet payments (Google/Apple Pay) if marketed correctly on your store.

“The shift to A2A is happening fast. Instant payments will account for one in three of all consumer transactions globally by 2029 or sooner” David Birch – Forbes

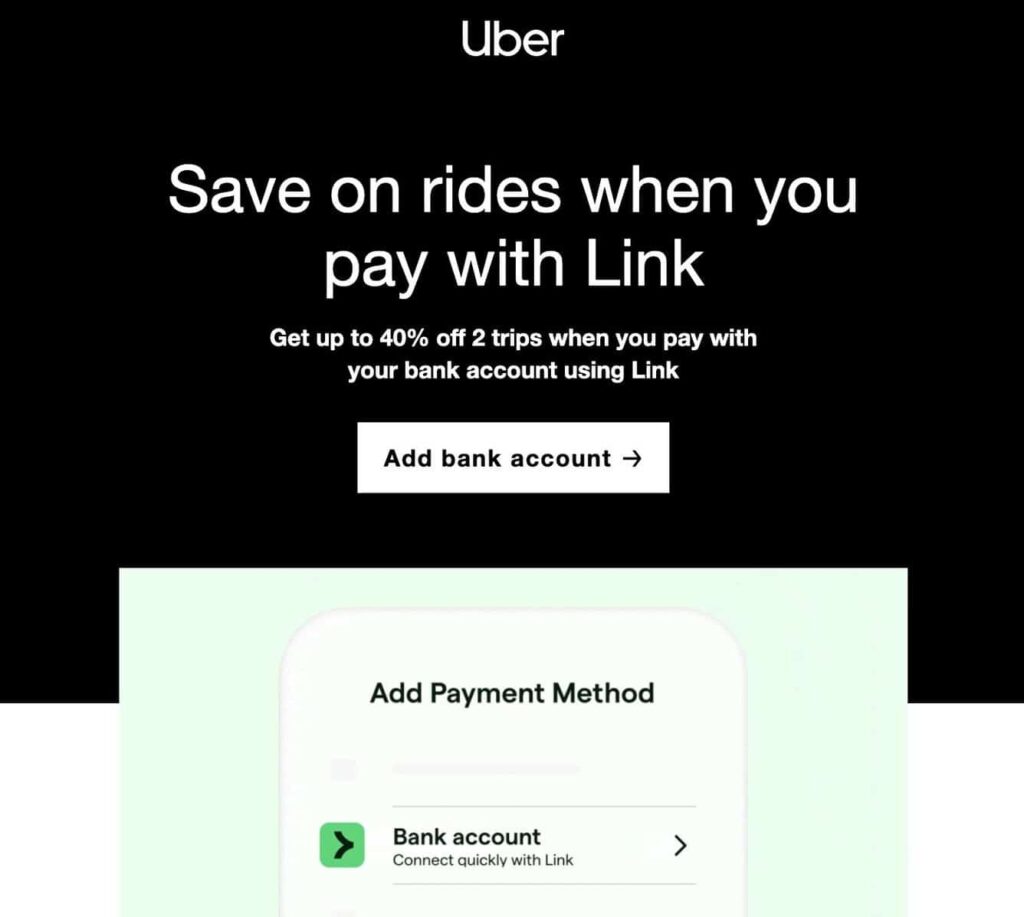

The likes of Uber have now adopted this payment method and are pushing customers to make this change within their accounts. Uber has even added an offer of 40% off 2 trips when switching to this payment option.

Great marketing tactic.

What is Pay By Bank?

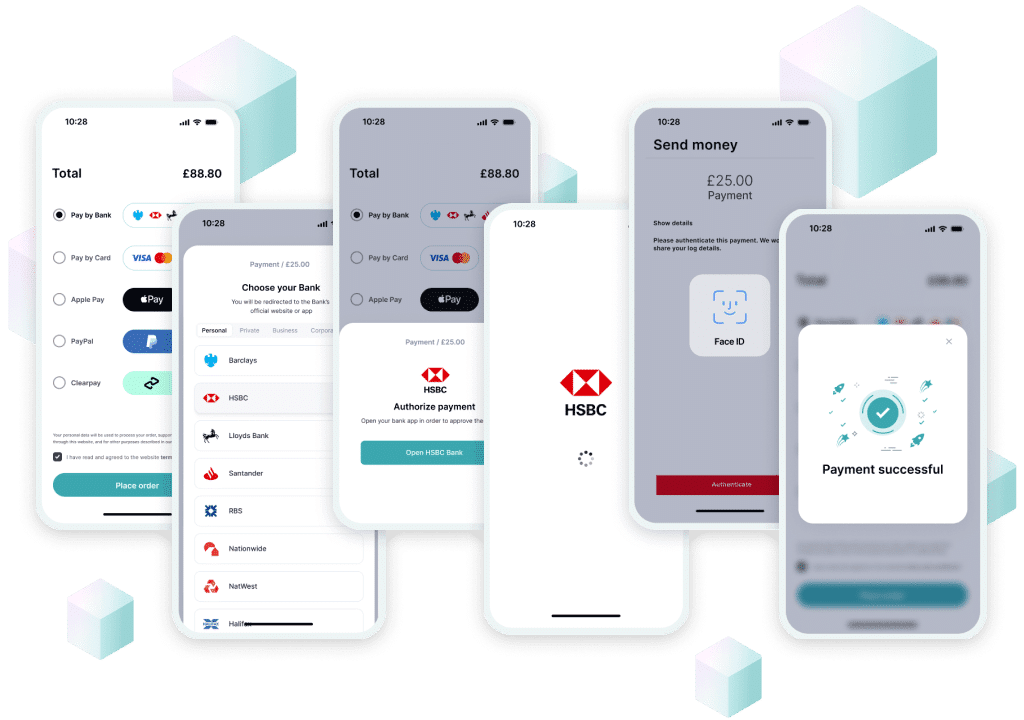

It’s quite simple. Instead of adding your card details or checking out through a wallet payment, you check out by authorising your bank to make a payment directly to the store’s bank account. It’s as simple as that.

These benefits are huge from a merchant perspective and offer great consumer confidence for purchases.

- As little as 0.4% transaction fee versus card payments which can be as high as 2% – 3.5%

- High conversion rate due to simplicity of transaction process

- Instant settlement to a merchant’s account versus 2-5 days from a card payment perspective

- Instant refunds to customers versus several days, even weeks if not longer

- Bank-grade security

From a consumer perspective, the last two points above give reassurance from a security perspective and consumer confidence in a quick refund process.

With many payment providers scrambling to get this feature added, one front-runner in this is Rvvup. I caught up with David Nunn, Founder & CEO of Rvvup. He guided me through their platform and how Pay By Bank is disrupting the market. These are David’s words;

“In today’s fast-paced digital marketplace, businesses are continually looking for ways to streamline operations and enhance efficiency. One area that often presents challenges is managing multiple Payment Service Providers (PSPs) for various payment methods. Streamlining fragmented processes is where a next-gen PSP like Rvvup comes into play, offering a unified platform that consolidates all payment needs under one roof.”

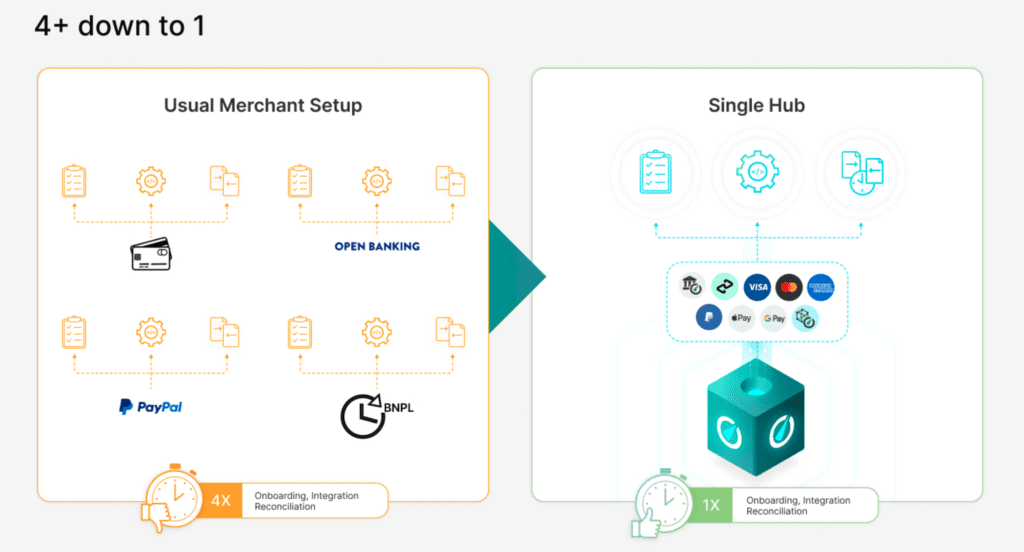

“For merchants, managing multiple PSPs triples their workload. With each PSP, they must first complete the onboarding process, then integrate the payment system, and finally, reconcile the transactions processed by that PSP. The latter is a process that never ends as reconciliation takes place regularly once the merchant is live. To put this into perspective, if a merchant works with 4 separate PSPs, they are juggling 12 distinct workstreams initially, followed by 4 ongoing streams dedicated solely to reconciliation.”

Simplifying Reconciliation

“Before transitioning to Rvvup, our customers faced the cumbersome task of accessing separate PSP systems to retrieve transaction data for each payment method. The reconciliation process was time-consuming and required manual extraction and a combination of sensitive transaction data into a spreadsheet. This not only involved finicky work but also took up valuable hours, if not days, each month.“

“Rvvup’s payment platform has revolutionised this process by consolidating transaction data for cards, PayPal, BNPL, and Pay by Bank into one platform. The need to manage multiple PSPs is eliminated. This integration allows for easy analytics spanning all payment methods, transforming reconciliation into a more efficient and less time-consuming task. With everything in one place, consumers now have a clearer overview of their financial transactions, and instead of spending time collating data, they’re now analysing it, enabling better decisions.“

Adding New Payment Methods Without the Hassle

“Another significant advantage of using a single PSP like Rvvup is the ability to add new payment methods without the complexity of integrating additional PSPs.“

“One customer of ours sought the benefits of A2A (open banking) payments but was already juggling multiple PSP integrations for cards, PayPal, and Clearpay.“

“Typically, adding Pay by Bank would require onboarding, and then integrating and configuring a new PSP, thereby further complicating the website and multiplying the reconciliation workload.”

“However, with Rvvup, merchants can now seamlessly incorporate Pay by Bank alongside existing payment methods like cards, PayPal, and Clearpay, all through a single connection.“

“This not only enables consumers to leverage the benefits of A2A payments but also simplifies their reconciliation process by consolidating their PSP connections down to just one.“

Rvvup’s Conclusion For Merchants

“The benefits of using a single PSP like Rvvup are clear. Merchants can simplify their reconciliation processes, easily add the latest technology and new payment methods without additional integrations. Plus they can enjoy a more streamlined and efficient payment solution.“

“By consolidating all payment needs under one roof, businesses can focus more on growth and less on the complexities of payment management.“

“If you’re a merchant looking to simplify your payment solutions and enhance operational efficiency, consider the advantages of a unified payments platform like Rvvup. It could be the game-changer your business needs.“

This approach from Rvvup for merchants is, as they say, a game-changer.

With integrations into ERP/OMS and accounting software, this will make light work for your accounts team as well as offer multiple options for checkout payments.

Rvvup has also built a Hyvä compatible module for Hyvä theme and Hyvä checkout which is a bonus if your ecommerce platform is Adobe Commerce / Magento Open Source.

This will be a strong conversion driver for the B2B market. Possibly over D2C and B2C but time will tell. The reason for this is the simplicity of the transaction process and the speed of payments/refunds.

One of the big pain points for sole traders and B2B businesses is the settling of accounts. Adding this to your tech stack for your customers to use will no doubt make this easier to settle accounts quickly. This will also save time for your customer service team and may help reduce calls.

My conclusion… If Pay By Bank is an option and marketed well in your store, this will soon become the go-to option for your customers, saving you money and making customers happy.

When are you adopting Pay By Bank?

If you would like to talk about Pay By Bank, please get in touch today.