Work

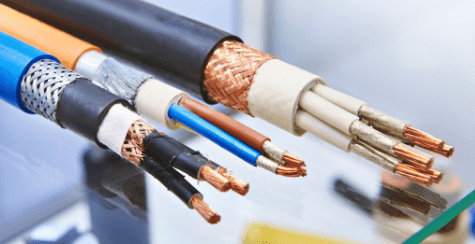

FS Cables is a leading supplier of high-quality cables and accessories, offering a wide range of solutions for industries including data networking, audio-visual, and automation.

The company came to us in March 2024 looking for specialist help with their Google ads campaigns. The directors at FS Cables were concerned about their creeping (cost-per-click) CPC costs, and stated the need to grow sales and improve profitability from the campaigns during the coming months.

Fluid Commerce’s expert PPC team conducted a comprehensive audit of FS Cables’ campaigns and devised a strategic overhaul to drive meaningful results.

The outcome was a success, exceeding the company’s expectations. From October 2024 to March 2025, we delivered strong growth for FS Cables’ campaigns, generating 20% revenue growth and 30% ROAS increase.

Knowing that CPCs are raising across the board, and how challenging it is to improve this metric, we agreed on working towards the following objectives to increase sales and return on ad spend (ROAS):

B2B focussed PPC to both revenue growth through your ecommerce platform and new customer acquisition

Retail search and shopping campaigns on Google Ads and Microsoft Ads to drive your ecommerce growth.

Using the power of paid social media, we craft personalised brand experiences for your audience to give you a bold and powerful edge over your competitors.

We first carried out an audit of FS Cables’ Google Ads account, which revealed several areas for improvement.

The Performance Max campaigns were not effectively segmented to accommodate FS Cables’ extensive product catalogue, leading to inefficiencies in budget allocation and ad relevance. Without proper segmentation and a small budget, higher-margin or best-performing products were not prioritised, resulting in missed opportunities for maximising return on investment.

Generic search campaigns delivered high traffic, but extremely low conversion rates due to relying extensively on broad match keywords. These keywords generated traffic from unrelated searches, leading to low sales and a barely break-even ROAS and missing out on valuable traffic from broader, high-intent keywords.

Brand search campaigns exhibited a low conversion rate due to suboptimal match type selection and automated bidding strategies. We found that adjusting these elements could improve efficiency and conversion performance, whilst keeping the brand protected.

Additionally, campaigns were targeting regions outside the UK without proper conversion tracking, making it difficult to measure performance and optimise spend. Without tracking in place, it was impossible to determine which regions were generating sales, leading to wasted ad spend and a lack of data-driven decision-making for international targeting strategies.

Fluid Commerce’s solution hinged on a three phase approach:

Our first port of call focused on product performance. Using Shoptimised, we made updates on the product feed, optimising titles, descriptions, and other important product attributes that could lead to higher visibility for them.

To drive smarter investment and optimise product visibility, we reviewed product performance over the previous six months. Each product was categorised based on historical performance metrics such as conversion rate, click-through rate, and revenue contribution:

This allowed us to prioritise high-performing products for increased visibility and budget allocation.

gin into the new site to purchase, view past orders and manage their accounts. Our approach unified all of the data correctly and the customer now only logs in through one website, giving them access to more categories and a deeper product range.

The consolidation will help to improve SEO for Fletcher Stewart as previously they had category pages competing against each other. It has also helped to improve efficiency at the company as the internal team is now looking after data for one website, instead of four.

Simultaneously, we tested underperforming or low-visibility products in controlled environments to uncover potential new top sellers. This approach not only maximised ROAS but also uncovered overlooked products that responded well to targeted exposure, creating a feedback loop for continuous optimisation.

We also introduced a Shopping Catch All campaign with low bids, covering the entire product range (4,500+ products) to ensure any products that showed promise and not present in PMax campaigns were accounted for.

Following this, we redesigned the generic search strategy by reintroducing exact and phrase match types into these campaigns. This move aimed to regain control over which keywords triggered ads, improve search intent alignment, and reduce wasted spend associated with broad match queries.

We focused on long-tail keywords (with lower competition and higher intent) and part numbers often searched for by the brand’s target customers. This allowed us to reach niche audiences with more relevant messaging. The result was improved match relevance, 54% higher click through rates, a 32% decrease in cost per conversion, and 64% higher ROAS.

To defend FS Cables’ brand equity and prevent competitors from hijacking branded search traffic, we transitioned brand campaigns from automated to manual bidding. This shift allowed us to ensure top-of-page visibility for branded queries while maintaining cost-efficiency.

Brand CPCs dropped dramatically by 53%, delivering more traffic to the website. With higher budgets pulled from pausing the global campaigns targeting territories outside of the UK with no tracking in place, we increased our brand Impression Share by 516% and delivered 415% more sales and 65% higher ROAS YoY.

This tactic also helped maintain a consistent user journey for customers specifically seeking FS Cables, and ensure their longevity while protecting LCV.

Despite an 8% decrease in spend, performance saw significant improvements, with a 134% increase in conversion rate and a 28% rise in total conversions. Revenue grew by 20%, while return on ad spend (ROAS) surged by 30%, achieving a more efficient and profitable paid strategy.

Work That Delivers

Lorem ipsum dolor sit amet, consectetur adipiscing elit.